Your #1 Destination

for Online Trading

Next generation broker for traders that aim for excellence!

Get started

Access Global Markets with Superior Trading Conditions

40+ years of Group

cumulative experience

Negative balance

protection

Ultra-fast

execution of orders

Professional

Customer Support

Trade the Most Popular Assets

We take great pride in combining some of the best trading conditions in the industry with rapid market execution.

Various order types

Various order types  Super-tight spreads

Super-tight spreads  Hedging allowed

Hedging allowed  Maximum fund security

Maximum fund security  Many payment methods

Many payment methods CFDs on

| Instrument | |

|---|---|

EUR/USD | |

EUR/JPY | |

NZD/USD | |

USD/JPY | |

AUD/USD |

| Buy | Sell | Change | Chart | |

|---|---|---|---|---|

| 1.17262 | 1.17261 | 0.09% | ||

| 174.232 | 174.224 | -0.26% | ||

| 0.57814 | 0.57806 | 0.2% | ||

| 148.581 | 148.579 | -0.34% | ||

| 0.65757 | 0.65751 | 0.31% |

*Indicative spread is in HYCM Raw Account

See all products Get started

Get started Powerful Trading Platforms

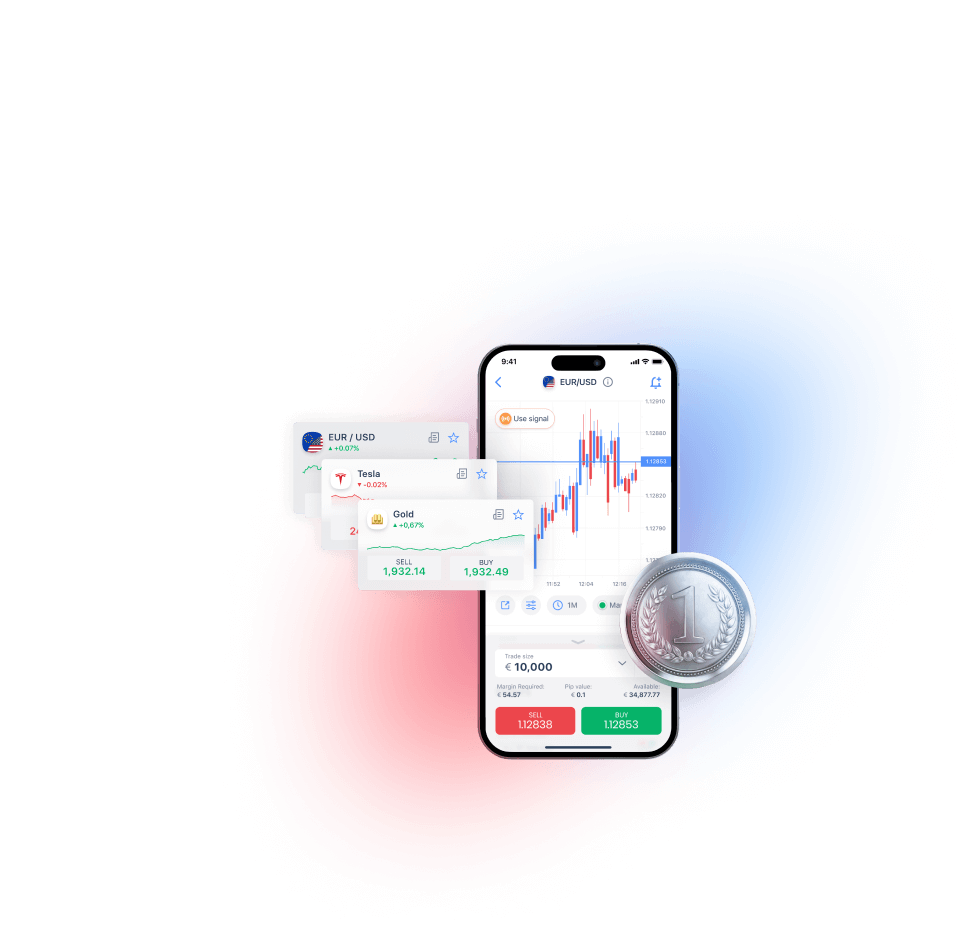

Our trading app is innovative, clutter-free and intuitive to use. Access and manage all your accounts, discover new opportunities, and trade our range of 300+ instruments directly from your phone. Create personalised price notifications, so you never miss a trade again!

The Web Terminal is available for both MT4 and MT5 users. It allows you to trade from your browser without the need to download any additional software.

Established as the industry standard, it contains everything a trader needs. It offers many features like advanced technical analysis, flexible trading systems, Expert Advisors, as well as a mobile app.

Negative balance protection

Data encrypted by: VeriSign

Client Funds Kept in Tier-1 Banks

25+ Global Awards

Unleash Your Trading Potential with HYCM Trading Account

Min. deposit

$20

Max Leverage

1:30

Spread

From 0.1

Swap free**

Yes

Spread type

Fixed /Variable

**Only for certain products. For more information here

Account Types Comparison Table Open An AccountHYCM Financial Tools

Benefit from our wide range of tools, including calculators and free access to services like Seasonax and Financial Source.

Seasonax

Identify seasonal investment opportunities for 20,000+ stocks, commodities, indices, and currencies with Seasonax.

Get started

Financial source

Track market moving events in real time with Financial Source. Stay tuned into what’s moving the markets and uncover the reasons why.

Get startedReady to get started

Start trading in 3 easy steps

Register

Create a profile

in less than 2 minutes.

Get verified

Send us the proof of identity to verify your profile.

Deposit funds

Fund your account

and start trading.